Gift Limit 2025 Per Person Based. In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. The annual gift tax exclusion of $18,000 for 2025 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax.

You can give as many gifts of up to £250 per person as you want each tax year, as long as you have not used another allowance on the same person. The exclusion will be $18,000 per recipient for 2025—the highest exclusion amount ever.

The parliament of india introduced the gift tax act in 1958, and gift tax is essentially the tax charged on the receipt of gifts.

In general, the gift tax and estate tax provisions apply a unified rate schedule to a person’s cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

Gift Tax Limit 2025 Exemptions, Gift Tax Rates & Limits Explained, In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. 2025 gift tax exemption limit:

IRS Gift Limit 2025 All you need to know about Gift Limit for Spouse, Tax on gifts in india. In general, the gift tax and estate tax provisions apply a unified rate schedule to a person’s cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

Maximum Irs Gift 2025 Reeta Celestia, There are many common misunderstandings about the gift tax. (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.) for.

Irs Business Gift Limit 2025 Crin Mersey, There are many common misunderstandings about the gift tax. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

New 2025 Gift and Estate Tax Limits YouTube, 2 you’ll have to report any gifts you give above. You can give as many gifts of up to £250 per person as you want each tax year, as long as you have not used another allowance on the same person.

Gift and Estate Tax Exemption Limits Increase for 2025 Gold Leaf, Annual federal gift tax exclusion. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

2025 Gift Tax Limits Peggi Tomasine, 2 you’ll have to report any gifts you give above. For 2025, the limit increases to $36,000.

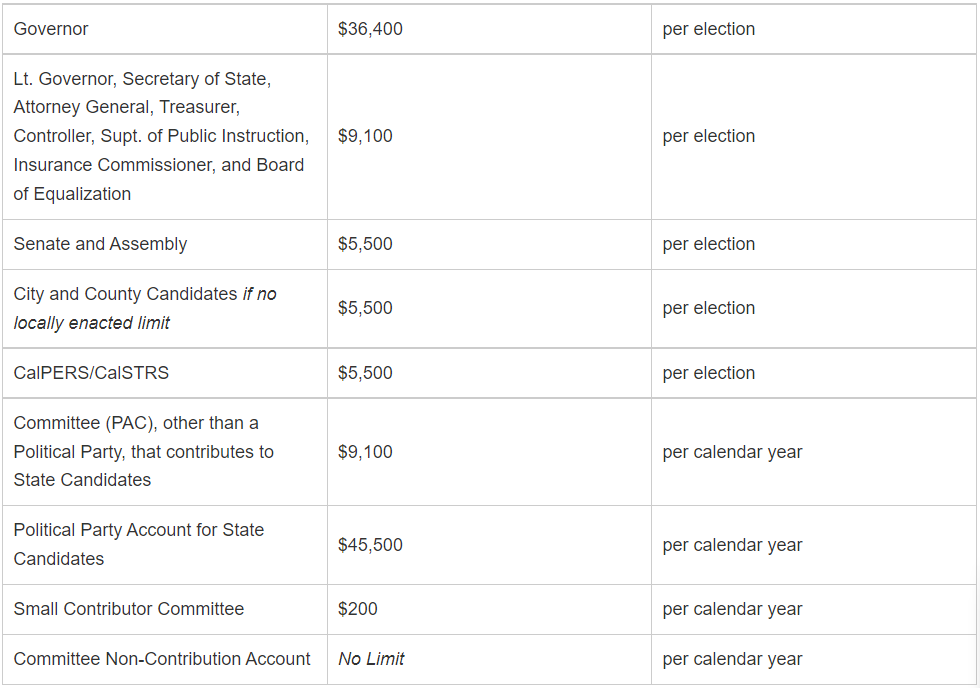

California Raises Campaign Contribution and Gift Limits for 20232024, In general, the gift tax and estate tax provisions apply a unified rate schedule to a person’s cumulative taxable gifts and taxable estate to arrive at a net tentative tax. 2 you’ll have to report any gifts you give above.

IRS Gift Limits From Foreign Persons 2025, The 2025 lifetime gift limit is $13.61 million, up from $12.92 million in 2025. But even if you exceed that amount, there are some.

Irs Business Gift Limit 2025 Crin Mersey, The 2025 lifetime gift limit is $13.61 million, up from $12.92 million in 2025. You can give as many gifts of up to £250 per person as you want each tax year, as long as you have not used another allowance on the same person.

You can give up to the annual exclusion amount ($17,000 in 2025 and $18,000 in 2025) to any number of people every year, without facing any gift taxes or.