New York State Exempt Salary Threshold 2025. In 2026, the new york exempt salary threshold will increase to $62,353.20 annually ($1,199.10 weekly) in areas outside of new york city, westchester county, and long island. Ny state exempt salary threshold 2025.

In addition, beginning march 13, 2025, employees in new york state must. The current salary threshold for exempt status for executive, administrative, and professional (eap) positions is $684 per week (the equivalent of.

The minimum wage increased on january 1, 2025 to $16.00 per hour in new york city, westchester, and long island and to $15.00 per hour in all other counties in.

New york recently raised the minimum salary basis thresholds for executive and administrative employees in order to satisfy the exemption from overtime, not to be.

New York State Minimum Salary Exempt 2025 dinah elbertina, If the historical salary basis threshold of 75 times the minimum wage remains the same, the 2025 exempt salary threshold for such employees in new york. The new york state labor department approved new minimum salary thresholds for exempt executive and administrative workers for the next three years.

New York State Exempt Salary Threshold for 2025, New york is increasing the weekly salary threshold for exemption from state wage payment laws to $1,300 from $900, under a. Nys salary thresholds rising in 2025.

New York State Minimum Wage and Exempt Salary Threshold HRtelligence, The new york state department of labor (dol) published. Increased salary thresholds for exempt workers.

DOL Proposes New Exempt Salary Threshold To Start In 2025, New york is increasing the weekly salary threshold for exemption from state wage payment laws to $1,300 from $900, under a bill that will go into effect on march 13,. The new york state department of labor (dol) published.

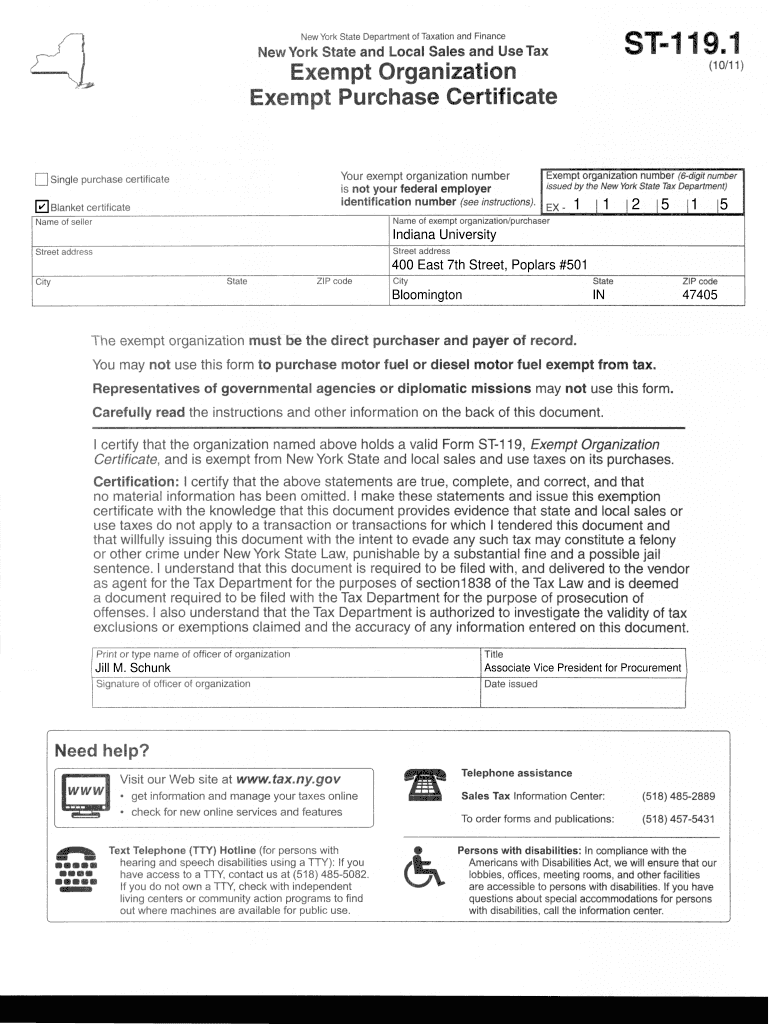

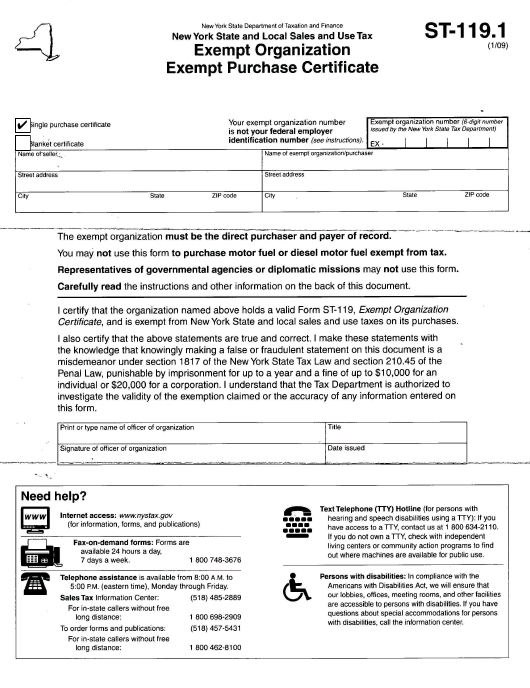

New York State Tax Exempt Form St 119, Effective january 1, 2025, the new york state salary threshold for exempt executive and administrative employees is as follows: As such, the professional exemption under new york law will continue to be subject to the federal professional exemption salary threshold, currently set at $684.00.

What to know about minimum wage, exempt salary level increases for 2025, Nys salary thresholds rising in 2025. On august 30, 2025, the dol released a proposed rule that, if finalized, would increase the minimum salary required to $1,059 per week in order for.

2025 Changes to Minimum Wage and Overtime Exempt Salary Threshold, New york is increasing the weekly salary threshold for exemption from state wage payment laws to $1,300 from $900, under a. Increased salary thresholds for exempt workers.

New York State Tax Exempt Form Farm, The nydol has set yearly increases to those thresholds for the next three years starting in 2025 as follows: The current salary threshold for exempt status for executive, administrative, and professional (eap) positions is $684 per week (the equivalent of.

The Complete Guide To New York Payroll & Payroll Taxes, As such, the professional exemption under new york law will continue to be subject to the federal professional exemption salary threshold, currently set at $684.00. The minimum wage increased on january 1, 2025 to $16.00 per hour in new york city, westchester, and long island and to $15.00 per hour in all other counties in.

Department of Labor proposes pay change How New York businesses will, As of january 1, 2025/2025/2026, the minimum annual salary thresholds for employees classified as “exempt” from overtime under the executive or administrative exemption are/will be as follows: 2025, employees in new york state must be paid at least $1,300 per week ($67,600 per year) to be exempt.

New york recently raised the minimum salary basis thresholds for executive and administrative employees in order to satisfy the exemption from overtime, not to be.